Welcome to our detailed guide on navigating the intricacies of a 1031 exchange. This financial tactic can be a game-changer for investors looking to defer capital gains taxes, but it comes with its share of complexities and requirements. In this blog post, we’ll dive into best practices that can help ensure a successful transition amidst today’s market dynamics.

The 1031 exchange, also known as a like-kind exchange, allows real estate investors to postpone paying tax on the gain of a property sale if another, similar property is purchased with the profit gained by the sale. Understanding the critical steps and strategies can make this process smoother and more beneficial for your investment portfolio.

Understanding Eligibility Requirements

One of the foundational steps in a 1031 exchange is verifying that your transaction meets all eligibility criteria. Both the property being sold and the property being acquired must be held for either business or investment purposes. Importantly, primary residences do not qualify. For a fuller understanding of 1031 eligibility requirements, check this informative piece: https://businessnewsthisweek.com/business/top-tips-for-navigating-a-1031-exchange-in-todays-market/#google_vignette.

Accurately categorizing your properties and ensuring they meet these conditions are crucial. Mistaking these could lead to an unsuccessful exchange and potential tax liabilities. Consulting with a tax advisor or specializing in real estate laws could provide additional clarity and compliance assurance.

Selecting the Right Replacement Property

Choosing an appropriate replacement property is critical in fulfilling the requirements of a 1031 exchange. The replacement property should not only be similar in nature but should also be of equal or greater value to fully defer capital gains taxes. It’s essential to conduct thorough market research and possibly consult with an expert who can help identify properties that offer growth potential and align with your long-term investment goals.

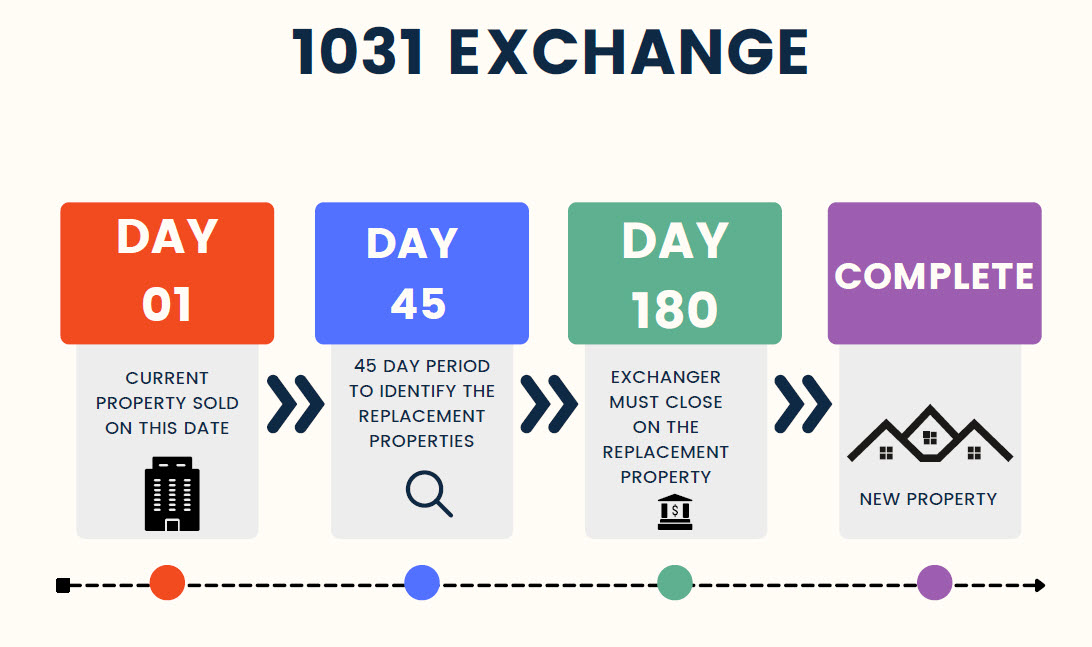

Make sure to stay within the timeline prescribed by IRS guidelines when identifying potential replacement properties—45 days from the date of sale of your original asset to declare potential replacements and a total of 180 days to close on the new property.

Tackling Timing Challenges

Timing is everything in a 1031 exchange. From the day you sell your investment property, you have exactly 45 days to identify potential replacement properties and up to 180 days to complete the purchase. Planning plays a crucial role; procrastination or misalignment in timing can jeopardize the tax-deferral benefits.

Assembling a competent team including a qualified intermediary who will hold the proceeds from your sale until they can be transferred to the seller of the replacement property can help manage these tight deadlines effectively.

Maintaining Proper Documentation

To validate the legitimacy of your 1031 exchange, keeping meticulous records is imperative. This encompasses all documentation related to both the relinquished property and replacement property—purchase agreements, proof of ownership, financial statements, closing statements, etc. These documents form the backbone of your defense should any element of your exchange face scrutiny from tax authorities.

Besides helping with IRS audits, good documentation assists in tracking your investment progress over time and can guide future decision-making processes accurately.

Leveraging Professional Guidance

Given the complexities involved, surrounding yourself with professionals who are well-versed in 1031 exchanges can significantly amplify your chances of success. A qualified intermediary plays a pivotal role by holding onto sale proceeds and ensuring funds are correctly applied to facilitate the exchange. Additionally, tax advisors specializing in real estate investments can provide advice tailored to your specific circumstances which maximizes benefits.

Frequently revisiting strategies with experts during each step of your 1031 exchange not only helps adhere to legal frameworks but also aids in maximizing investment returns tailored delicately across market shifts.

In conclusion, while a 1031 exchange offers tremendous opportunities for deferring taxes while reinvesting in new properties, achieving success requires meticulous adherence to IRS regulations, strategic planning, and timely action. By following these best practices and utilizing professional resources wisely, investors can effectively navigate through their transactions smoothly and reap significant long-term benefits from their real estate investments.

We hope this guide empowers you with detailed insights into executing a successful 1031 exchange. Remember, every investment move should ideally parallel both current market trends and individual long-term financial goals.